France's nuclear industry giants - EDF, Framatome and Orano - have each reported improved results for 2023, compared with 2022, and expect continued growth in 2024, partly due to France's plan to build new reactors. EDF - which was renationalised last year - recorded sales of EUR139.7 billion (USD150 billion) and earnings before interest, tax, depreciation and amortisation (EBITDA) of EUR39.9 billion in 2023. The group's net income totalled EUR10 billion, following record annual losses of EUR17.9 billion in 2022. The company said its "exceptional" results were "driven by a very good operational performance, achieving a significant 41.4 TWh increase in nuclear generation in France in a context of historically high prices". It added: "Coming after the sudden drop in nuclear power output in France in 2022 due to the stress corrosion phenomenon and exceptional regulatory measures to limit price rises for consumers, these results have reduced net financial debt." In France, nuclear power output totalled 320.4 TWh, in the upper end of the range announced for the year. EDF said: "This turnaround was achieved by good management of the stress corrosion repairs and reactor outages, thanks to efficiency and reactivity of the teams to improve the fleet availability." As of the beginning of January 2024, 46 French reactors were online, representing total capacity of 50 GWe. Of the 16 reactors most sensitive to stress corrosion, 15 had been repaired by the end of 2023, and the final one will be repaired during its ten-year inspection, which starts this month. Additionally, the 2023 programme of checks on welds repaired during reactor construction has been completed. EDF estimates that its nuclear output in France will be 315-345 TWh in 2024 and 335-365 TWh in 2025 and 2026. EDF's UK nuclear fleet generated 37 TWh of electricity last year, providing about 13% of Britain's total power demand. Output was 15% lower than in 2022 due to station closures and statutory outages but nearly four times the forecast when EDF acquired the fleet in 2009. In the UK, EBITDA was GBP3.4 billion (USD4.3 billion) and net investment was GBP3.6 billion, meaning investment was greater than EBITDA for the sixth year running. EDF said it will invest a further GBP1.3 billion in the five generating stations over the next three years in a concerted effort to keep nuclear output stable after several years of decline due to older stations retiring. This comes on top of GBP7.5 billion of investment since EDF acquired the fleet 15 years ago. "The strong operating performance of EDF in the UK and the support of the Group enabled us to continue to invest significantly in Britain in 2023," said Simone Rossi, CEO of EDF in the UK. "EDF is a long-term partner to Britain, and I am proud of our role over 25 years strengthening the country's energy security and cutting carbon emissions." With regards to its new build projects, EDF noted that at the Flamanville 3 EPR projects in France the tests to requalify the entire installation were successfully completed, in preparation for fuel loading in March. Meanwhile, at the Hinkley Point C project in the UK, EDF announced last month that the plant was now unlikely to be operational before 2030, with the overall cost revised to between GBP31 and GBP34 billion (in 2015 prices). It noted an impairment of EUR12.9 billion was booked, mainly relating to Hinkley Point C assets but also including EDF Energy goodwill, partly as a result of aging plants. It added that since the start of 2024 construction at Hinkley Point C was being financed by the shareholders on a voluntary basis, and EDF is currently financing all costs. "2023 marks the return of the company's operational performance at a better level, after a year of industrial difficulties and exceptional regulation unfavourable effects in 2022," said EDF Chairman and CEO Luc Rémont. "With these good results, EDF has met its financial targets and reduced its financial debt. They also reflect the hard work put in by all EDF's teams to turn generation levels around, and provide appropriate sales offers for customers, and innovative solutions in response to the needs of the electricity system. "Finally, 2023 saw the start of key actions for the company’s future, with an intensive focus on change and efficiency improvements so we can remain the leader in carbon-free, competitive electricity production that is available at all times. I am certain that all these steps will continue to bring benefits over the next few years." In February 2022, French President Emmanuel Macron announced that the time was right for a nuclear renaissance in France, saying the operation of all existing reactors should be extended without compromising safety and unveiling a proposed programme for six new EPR2 reactors, with an option for a further eight EPR2 reactors to follow. EDF and Framatome are developing the EPR2 as a simplified version of the EPR design which incorporates design, construction and commissioning experience feedback from the EPR reactor, as well as operating experience from the nuclear reactors currently in service. EDF proposes to build three pairs of EPR2 reactors, in order, at Penly, Gravelines and Bugey.

EPR projects help Framatome: Meanwhile, nuclear engineering group Framatome reported revenue of almost EUR4.1 billion in 2023, with an organic increase of 9.1% compared with 2022. It said this growth was driven by the development of EPR projects in France and the UK and by an increase in service activities for EDF in France. EBITDA was EUR598 million, an increase of 4.7% compared with 2022. "The execution of projects was well controlled, and optimisation of overhead costs continued," it said. "Production in plants was in line with customer commitments despite supply chain tensions." Framatome noted its Installed Base Business Unit executed several primary component replacement operations for EDF on the French fleet and for Eskom in South Africa. It also strengthened its position on the highly competitive North American market, while equipment was successfully delivered to the Angra 3 project in Brazil and to Bruce Power in Canada. Framatome's Instrumentation and Control Business Unit continued to grow, driven by new build and modernisation projects in France, the UK and Central Europe. Losses were recorded in North America and have given rise to remedial actions, it said. The Projects and Components Business Unit activities were supported by the completion of weld repair work on the main secondary circuit and hot tests on the Flamanville 3 EPR. In the UK, several of the primary components for Hinkley Point C were delivered and the fabrication of forged parts and equipment for the Sizewell C project is well under way. "2022 was also marked by the ramp-up of design engineering work for the first serial production forgings of the EPR2 programme," Framatome said. Investments have been launched within the scope of the ramp-up in production of an industrial programme linked to the EPR2 programme in France. These investments relate to manufacturing and assembly activities for the primary and auxiliary equipment components.

Orano optimistic for 2024: Fuel cycle company Orano reported revenue of EUR4.8 billion in 2023, up 13.1% on a like-for-like basis, supported by rising market prices and increased front-end and back-end activity. EBITDA was EUR1.2 billion, up from EUR1.0 billion the previous year. "Thanks to its good results and in particular its continuous deleveraging over the past 6 years, Orano has put itself in working order to support the new nuclear energy prospects and meet the climate and sovereignty challenges," said Orano CEO Nicolas Maes. "The decision to increase our enrichment production capacity is a concrete illustration of this, and foreshadows other development projects in our nuclear base, and our new activities in nuclear medicine and the battery value chain. "Therefore, 2024 marks the start of a new cycle of development and investment in areas that are more essential and meaningful than ever."Researched and written by World Nuclear News.

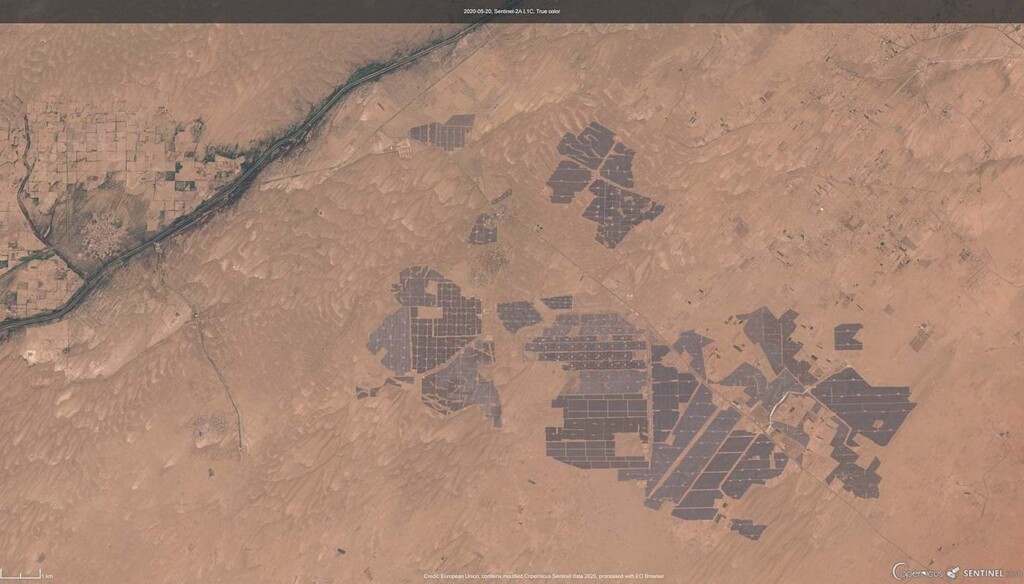

Improved fortunes for French nuclear sector : Corporate - World Nuclear News Bhadla Solar Park in Gujarat, seen from ESA’s Copernicus Sentinel-2, satellite, will pale in comparison to Khavda when it’s completed

Bhadla Solar Park in Gujarat, seen from ESA’s Copernicus Sentinel-2, satellite, will pale in comparison to Khavda when it’s completed

.jpg?ext=.jpg)