Rewheel figures show that T-Mobile’s purchase of Sprint has helped keep US mobile prices high

According to a new report from Rewheel, T-Mobile’s acquisition of Sprint in 2020 has contributed to the exorbitant mobile prices in the US.

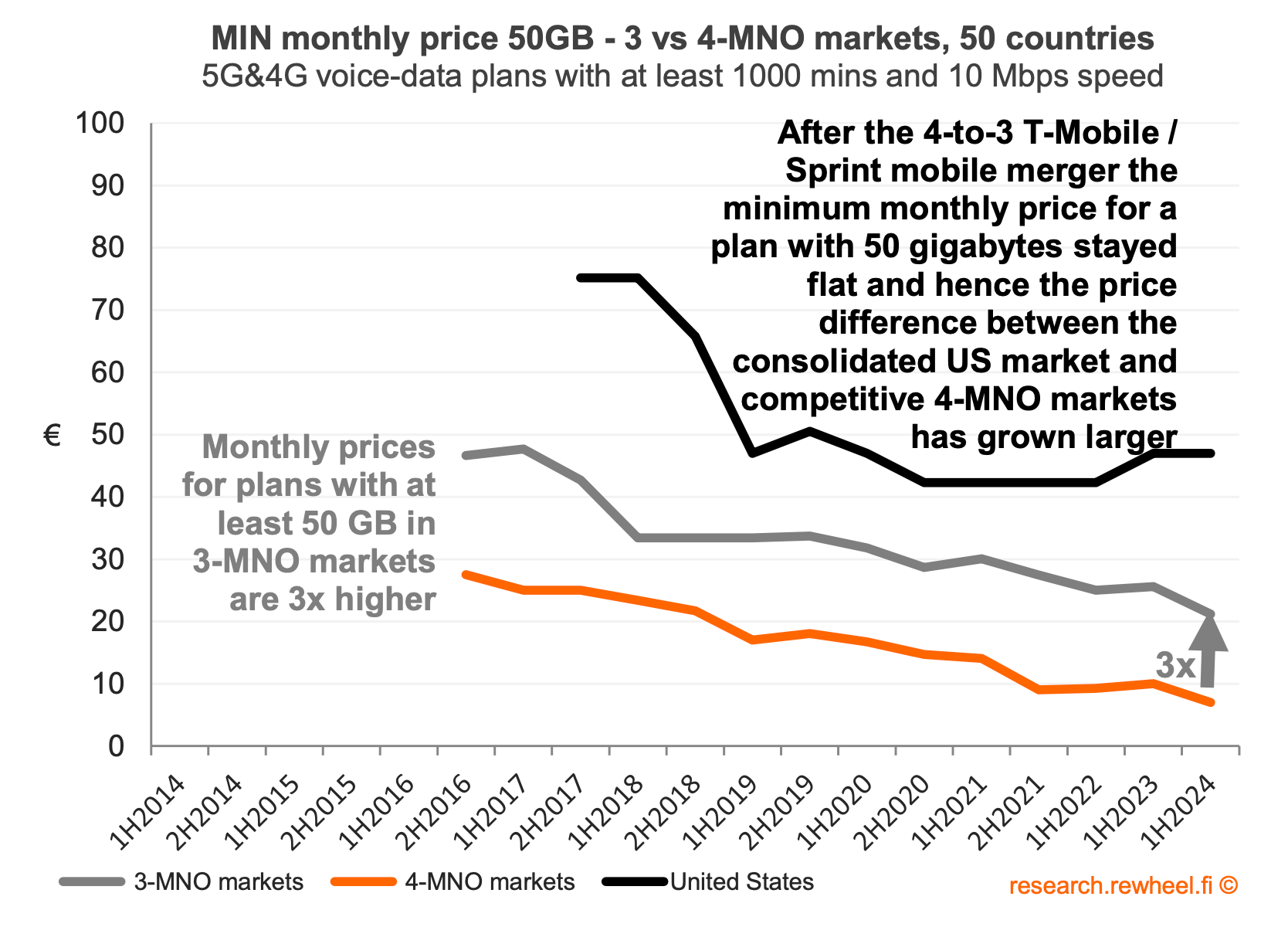

“Five years on, the Sprint / T-Mobile 4-to-3 mobile merger made the US one of the most expensive mobile markets in the world,” the firm wrote in the report. “While monthly prices were falling and continue to fall across mobile markets and while the same was true in the US mobile market prior to the merger, after the merger prices in the US either stopped falling altogether or fell at a much slower rate. The 4-to-3 mobile merger in the US led to higher prices and consumer harm.”

In general, Rewheel reported, “monthly prices are 2-3x higher and gigabyte prices are 5-6x higher in markets with only 3 mobile operators,” as compared to markets with 4 mobile operators. The findings were based on the monthly price of 50GB in voice and data plans with at least 1000 minutes and 10 Mbit/s speeds.

By contrast, the CTIA, the US wireless industry’s main trade association, found in its latest annual report that “the cost per megabyte of data decreased by 98% from 2012 to 2022.” The CTIA’s report also noted that 5G’s entrance into the home broadband market has increased competition and provided savings, even for non-subscribers.

For years, Rewheel has tracked global wireless industry prices. Its latest report echoes predictions the firm made in anticipation of T-Mobile’s $26 billion purchase of Sprint, which was then the fourth-largest wireless network operator in the US. While T-Mobile petitioned for regulatory approval of the acquisition in 2018, Rewheel reported that mobile prices for consumers typically fall at a faster rate in markets with four players.

As part of T-Mobile’s efforts to secure federal approvals for the purchase of Sprint, T-Mobile assured regulators that the mobile market would still have four mobile players. To achieve this, T-Mobile and the US Department of Justice (DoJ) struck an agreement with Dish Network to position Dish as the country’s fourth national provider.

While Dish has, so far, met its federal obligations under this deal, it continues to struggle in the US wireless market. Dish confirmed in June 2023 that its 5G network covered 70% of the US population, satisfying Federal Communications Commission (FCC) requirements. However, Dish has faced challenges in the postpaid wireless business and is currently struggling to finance its 5G network buildout.

When T-Mobile acquired Sprint, both companies argued the merger would create a more efficient company with low prices. Now, T-Mobile, along with Verizon and AT&T, is looking to raise prices for customers.

There are rumblings about further consolidation plans. T-Mobile and Verizon are reportedly in discussions to acquire parts of US Cellular. The news comes hot on the heels of T-Mobile’s acquisition of Ka’ena Corporation, the owner of Mint Mobile, and of its acquisition of Lumos through a joint venture with EQT.The Wall Street Journal has suggested that one reason for the piecemeal sale of US Cellular, as opposed to a wholesale takeover, is to avoid the ire of US competition authorities and the type of scrutiny the T-Mobile/Sprint merger has attracted. US mobile customers harmed by T-Mobile’s Sprint purchase according to report

2024-05-30T11:13:00+05:30