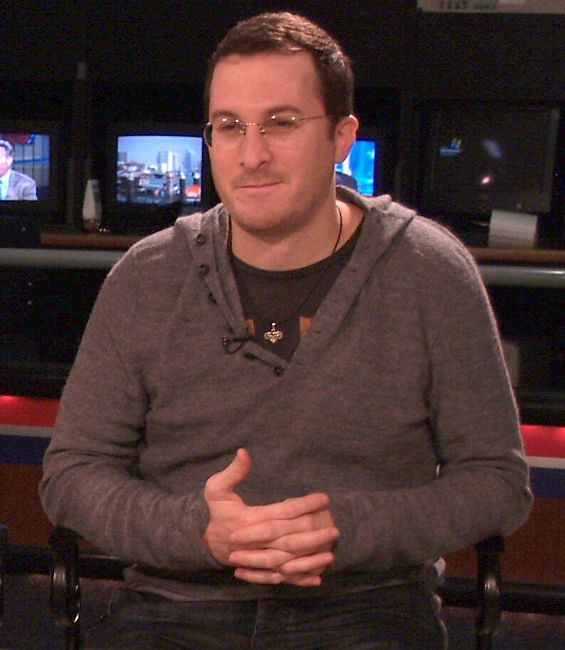

He likes to drive his characters mad and make his audience uncomfortable. But in persona, film-maker Darren Aronofsky, the mind behind intense and tough films like Black Swan is funny and easy. At a roundtable chat organised at the just concluded 12th International Marrakech Film Festival, he was full of quips and quotes. He also spoke at length about his forthcoming Russell Crowe film Noah. Excerpts: On hurricane Sandy’s impact on the filming of Noah: We actually were quite okay. We built a sea worthy vessel —the actual Ark was built in Long Island — which got wrecked since the impact of the Hurricane on Long Island was a lot. We couldn’t reach the sets for weeks. There was no electricity in that area for four days. But the emotional and human toll was much more than physical toll. On tweeting details about Noah: I’m a pretty private person. Agreed that Twitter is a pretty strange thing for me to get involved with, but I feel that we are in the New World so if one hasn’t got on to social media then one can feel left out. I’ve observed the great comedian Louis...