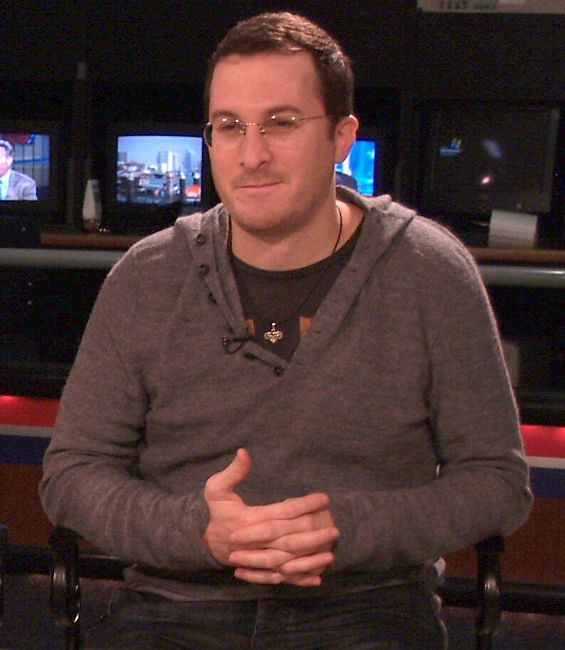

He likes to drive his characters mad and make his audience uncomfortable. But in persona, film-maker Darren Aronofsky, the mind behind intense and tough films like Black Swan is funny and easy. At a roundtable chat organised at the just concluded 12th International Marrakech Film Festival, he was full of quips and quotes. He also spoke at length about his forthcoming Russell Crowe film Noah. Excerpts: On hurricane Sandy’s impact on the filming of Noah: We actually were quite okay. We built a sea worthy vessel —the actual Ark was built in Long Island — which got wrecked since the impact of the Hurricane on Long Island was a lot. We couldn’t reach the sets for weeks. There was no electricity in that area for four days. But the emotional and human toll was much more than physical toll. On tweeting details about Noah: I’m a pretty private person. Agreed that Twitter is a pretty strange thing for me to get involved with, but I feel that we are in the New World so if one hasn’t got on to social media then one can feel left out. I’ve observed the great comedian Louis C.K. over the years. That guy has made millions by talking to his fanbase! I still don’t know how filmmakers will benefit from Twitter, but personally I like talking to young filmmakers, enjoy participating in Q & A and teasing people a bit so I kind of like Twitter. The studio was a bit unsure but being on Twitter allowed me the chance to let out the first image of the film. Doing this on our own is way better, it restricts a big crane sitting on the set. So I guess, it works well. On the story of Noah and his Ark: I’ve been working on Noah forever. In fact this was the first film after Pi that I pitched. I’ve had all these ideas way before I became a filmmaker. Even Black Swan and The Wrestler were ideas I had way back when I was in college. In fact this is my fear—I feel I'm running out of ideas! Now that we are making Noah, they are saying making a Bible picture is the new trend but when we set out we got a lot of No’s and passes before finally we got our studios Paramount Pictures and New Regency interested in it. On his experiments with Indian films: I know Bollywood is kind of a bad word here. Is there a better word? (PS: On my prodding that we call it the Hindi Film Industry, so he can call it Hi Fi, he immediately caught on to the word). Yeah, Hi Fi is better! So I got into Hi Fi a long time ago — it was the same time when my interest in Chinese and Hong Kong films was beginning. I checked out quite a few Hindi movies. I love that one about the Great Bandit — Sholay. I also saw Bandit Queen which was kind of an art film. I like how Baz Luhrmann has taken up the ingredients of Hi Fi films and the way he utilises them. In my neighbourhood in Manhattan, there is a cinema place dedicated to Hi Fi so I keep checking out the stuff that’s playing there. On whether Noah is similar to Life of Pi: I saw Life of Pi and I liked it. There are some visual similarities in terms of the animals and water, but let's see how we do our VFX. On his jinx with superhero films like Batman, Wolverine: I'd like to think Noah was a superhero. He might not have a super power, but what he does is much like a super hero. It's been my dream to do this — to bring my original take on an old story. On the storylines of his films and their uncomfortable quotient: When people say my films make them uncomfortable, I say ‘Very Good!’ I think The Fountain had a kind of a happy ending. Even in Black Swan, she was kinda happy. The Wrestler too. I don’t know. The idea is to start of a character and lead on their conflict. I do agree that sometimes I tend to drive my characters mad, but then that’s okay, I guess. I like the tightrope walk between sanity and insanity that my characters take. It’s just a good story device — when people go slightly over the edge, you can look back and see what was before it. On whether he has it in him to ever make a comedy: As a student I made four shorts and a comedy. Comedian Chris Rock says there is a thin line between laughing and crying — in the former you laugh out the breath and in the latter, you take the breath in. Comedy is a scary genre because if you miss, then you miss. On whether he believes in the classical Hollywood happy ending: It never made sense to me even as a kid. I’m of the opinion that a happy ending is never always a good thing. I grew up in New York, where it wasn’t like that. Life comes with a lot of complications. You never know, who is happy or sad. Guess it is something to do with my big science background. Being trained as a biologist for a few years, I have an environmental take to life which alters my perspective. On if he’d like to change anything in any of his films: I never look back at films. If you look back in a film, you kind of get lost in it. When they were coming up with the DVD of Requiem for a Dream, I stayed out of it, but on the insistence of my sound guy, I watched it and I couldn’t recognise the person, who had made it. It was surely a different person, I could remember myself but I don’t think you can ever recreate the same kind of passion that you had for a film when you are really making it. After a while, you gotta let go. I believe a director never finishes a film, he abandons it. On the status of his HBO series Hobgoblin: It’s been a while I got on the project, but then when I’m making a movie, it’s like I’m in a submarine. I’ll get to it now. Hobgoblin is about a group of magicians and con artists, who use their powers of deception to defeat Hitler during WWII. On whether he believes in magic: Magic? It’s a loaded question? Do I believe in magic that makes a Tiger disappear from a box? Or the simple things? I get touched by magic. I love magicians. David Blaine is a dear friend. I can watch the little tricks these magicians come up with all day. Magical realism is my favourite genre by the way.‘director never finishes a film, he abandons it’ , Image: flickr.com