Nissan to invest $17.6 bn in EV development over next 5 years

India’s GDP growth likely to scale 7.5 per cent in FY 26: SBI report

Ola Electric faces tough year as market share drops over 50 pc in 2025

critical pivots for Trinidad and Tobago in 2026

Estonia's former prime minister Kaja Kallas.

Estonia's former prime minister Kaja Kallas. -

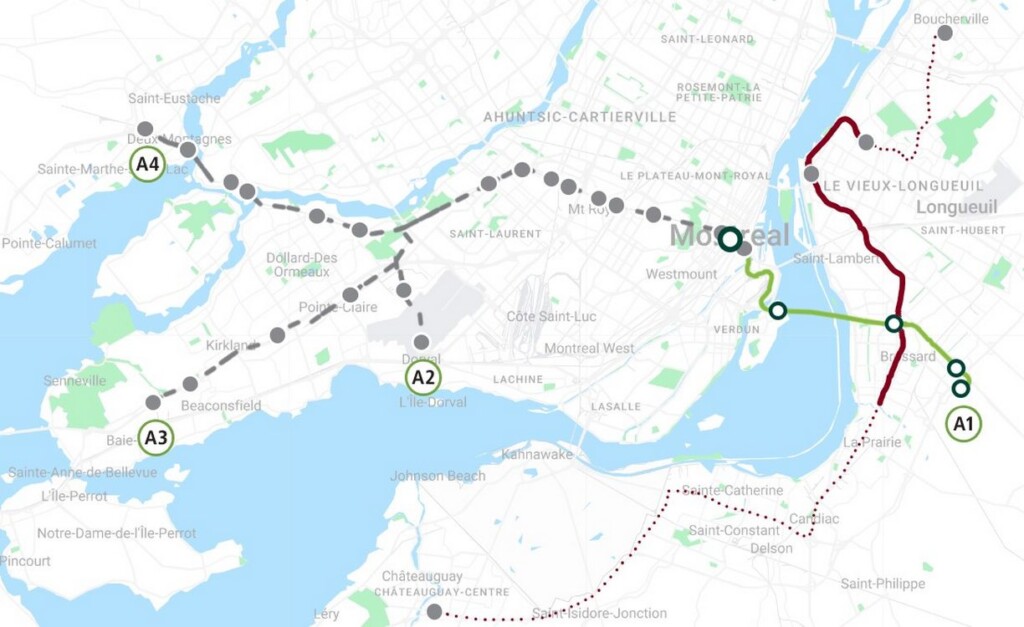

-Autonomous Montreal Metro Completed with Massive Cost Savings–Sets Example for Canada

Bajaj Finance loses over Rs 19,000 crore in market valuation this week

Australian economic growth is solid but not spectacular. Rate cuts are off the table

Stella Huangfu, University of Sydney

Australia’s economy grew by a softer-than-expected 0.4% in the September quarter, slowing from 0.6% growth in the June quarter. It confirms the recovery is tracking forward but without strong momentum.

Still, figures from the Australian Bureau of Statistics showed annual gross domestic product (GDP) growth was at a two-year high of 2.1%. That’s just above the Reserve Bank’s estimate of long-term trend growth of 2.0%.

The September quarter national accounts was the final major data release before the Reserve Bank’s meeting on 8–9 December.

The GDP result is steady enough to reassure the Reserve Bank the economy is not slipping backwards, while recent inflation data show domestic price pressures — especially in services — remain elevated. Together, the signals point clearly to a hold on interest rates next week.

All four major banks expect rates to remain on hold for many months, while financial markets on Wednesday were pricing in an 85% chance of a rate rise next year.

Across-the-board strength, led by IT

A key feature of the September quarter is the breadth of domestic growth.

In earlier quarters, much of the expansion came from the public sector — particularly government consumption and infrastructure spending — while private demand was subdued. This quarter marks a clear shift: private demand was the main driver, led by a strong lift in business investment, steady household consumption and continued public investment.

Domestic final demand rose solidly, with contributions from all major components — signalling improving confidence among both businesses and households and a more balanced base for growth than we saw earlier in the year.

Private investment led the gains, rising 2.9% – the strongest quarterly increase since March 2021.

Business investment in machinery and equipment jumped 7.6%, boosted by major data-centre projects in New South Wales and Victoria. IT-related machinery investment hit a record A$2.8 billion, double the June quarter, and aviation-related purchases also jumped. The Bureau of Statistics said in a statement:

The rise in machinery and equipment investment reflects the ongoing expansions of data centres. This is likely due to firms looking to support growth in artificial intelligence and cloud computing capabilities.

Household consumption rose 0.5%, but this was driven more by spending on essentials rather than discretionary items. A cold winter, reduced government rebates and a harsh flu season lifted demand for utilities and for health services.

Public investment grew 3.0%, after three quarterly declines. State and local public corporations led the rise through renewable-energy and water-infrastructure projects.

Coal exports are up

External conditions weakened this quarter as imports grew faster than exports.

Goods exports rose 1.3%, helped by a rebound in coal shipments and strong overseas demand for beef and citrus. Services exports were flat, as a fall in spending by overseas students offset a modest recovery in short-term tourism from China, Japan and South Korea.

Goods imports rose 2.1%, driven by demand for intermediate goods — especially diesel — and capital goods, mainly the data-centre-related equipment.

Companies drew down on inventories during the quarter, which acts as a drag on growth.

Households are saving more

Households remain central to the outlook. They are on firmer financial footing but still spending cautiously. The household saving ratio rose from 6.0% to 6.4%, helped by higher compensation of employees.

Economic growth per person (known as GDP per capita) was flat this quarter, but up 0.4% over the year. After several negative quarters, living standards appear to have stopped falling, though improvements remain modest.

Overall, households are in better shape financially but remain hesitant — a pattern that supports stability, not a consumption-led surge.

A steady result, but not enough to shift the rate outlook

Some parts of this quarter’s outcome — including the lift in machinery and aviation-related spending — are unlikely to be repeated.

For the interest rate outlook, however, the key issue remains inflation. Price pressures are still above the Reserve Bank’s target band, and services inflation has been slower to ease than anticipated. The Reserve Bank now expects a more gradual return to the 2–3% target band.

After three rate cuts earlier this year — the most recent in August — markets were expecting at least one more rate cut. That view has shifted. Sticky services inflation and a slower forecast decline mean expectations of further cuts have faded.

A steadier footing, but risks remain

The September quarter shows an economy on a steady, though still moderate, footing. Domestic demand is broad-based, investment is strong, and households have more income support — even if they remain cautious.

But this is not yet a turning point. Inflation is still above target. As Australia enters 2026, the Reserve Bank remains firmly on hold — but alert to the possibility that, if inflation stays above 3%, the next adjustment may need to be upward rather than downward.![]()

Stella Huangfu, Associate Professor, School of Economics, University of Sydney

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Macquarie Technology explores JV, capital recycling for $3bn data centre

Rupee crashes to record low beyond 90 per dollar

The High-End Fashion Industry’s Reaction to Economic Turmoil

UK’s Sizewell C achieves financing landmark

How the new plant could look (Image: Sizewell C)

How the new plant could look (Image: Sizewell C)Chinese company monopolises printing of Nepal’s banknotes for nearly three years

Worldwide spending on AI is expected to be nearly $1.5 trillion in 2025: Report

First-ever Startup World Cup in India in Oct, $1 million prize money up for grabs

Georgia clears debts to seven countries, including Armenia

.jpg)

India's tyre industry projected to see robust growth in current fiscal

Temasek Invests in Haldiram’s as India Becomes a Key Market

- HDFC Bank (private banking)

- Ola Electric (producing e-scooters)

- Zomato (food delivery)

- Manipal Hospitals (healthcare)

- Devyani International (KFC & Pizza Hut operator in India)

Suzuki to invest Rs 70,000 crore in India over next 5–6 years

IANS File Photo

IANS File PhotoWorldline Increases Payment Authorisation Rates With AI-Powered Routing Solution

- Omnichannel capability: the rules-based service can be used from multiple touchpoints for both online and in store transactions.

- Global reach: supports multi-currency, multi-acquirer environments with intelligent cross-border payment handling.

- AI-powered routing: this feature used global online businesses selects the most favourable acquirers, increasing conversion rates.

€631bn ‘Made for Germany’ initiative presents major opportunity for telcos